The concept of utility as a feature of NFTs is now a recurring topic of discussion in NFT Land. For the NFT creator focused on crypto art, utility might resonate as a useful marketing tool: adding additional value to works of art, or as another annoying distraction from the artist’s primary focus to make and share art. I spoke with Second Realm, a well-known artist working with both art and collectibles, to help clarify this important concept.

A Brief History of NFT Utility

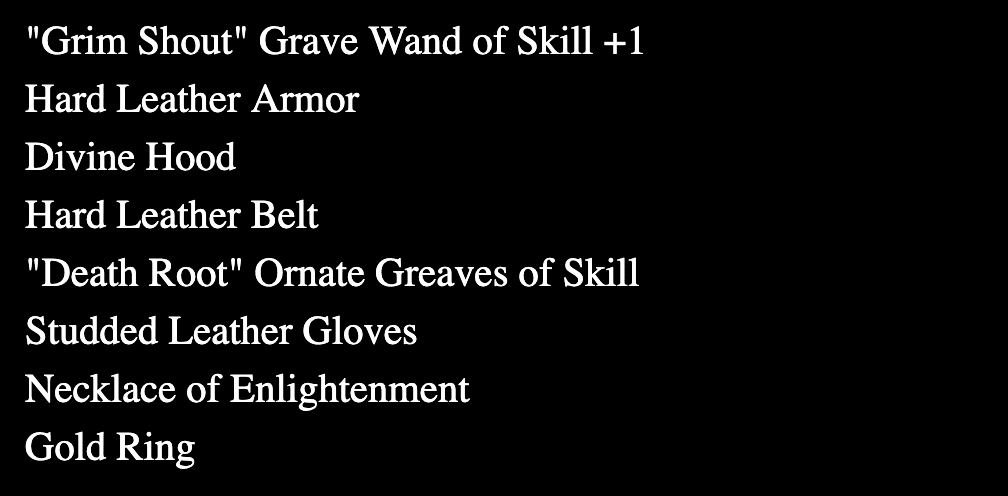

The notion of NFT utility could be coarsely defined as getting “extra stuff with your NFT.” I first began tracking the dialogue on Twitter in January with a statement from NFTS WTF DAO member Matty @DCLBlogger:

He clarifies in a follow-up that this perspective is:

The utility discussion eventually took on a life of its own, encompassing Matty’s value add examples and including related forms of marketing and community building by artists. As Nifty Gateway’s tommyk-eth observed in early September:

And then advised artists to:

Artists Respond to Calls for Utility

Many artists have explored approaches to utility and added value. Some began a bit earlier with the social currency trend that crypto artists and collectors helped kick-off. In fact, Roll’s current leading currencies are the $WHALE Community’s $WHALE and Hackatao’s $MORK.

Nevertheless, a large number of artists have responded to the growing call for NFT utility with a concern that it presents art as valueless when presented independently.

As Yonat Vaks put it, somewhat poignantly:

And, as I asked, with a bit of annoyance:

But perhaps artists were responding to the wrong demands from the wrong sources. I turned to one of the brightest minds I’ve encountered in the space, artist Eric Paul Rhodes, better known in crypto art circles as Second Realm, to dig deeper into the topic of NFT utility, especially as it applies to artists.

Second Realm on NFT Utility

When we spoke, Second Realm explained that he “almost always” takes a “broader” view of such terms as utility beyond established meanings:

“So when we start using words to define things I try to poke a hole in it and say, well what else can utility mean? Does it need to simply mean something that we have access to? Does it need to simply mean something that I get airdropped? I don’t think it does. And so, what I would say is, the act of owning NFT art is a utility in and of itself.”

He also clarified that he considers a wide range of possibilities in his understanding of NFT utility. These possibilities include NFT tech innovations, from Async Art‘s collaborative layers to Charged Particle’s use of DeFi. They also include community building and ‘artist access’ elements. And, of course, he includes the ever-popular ‘getting things for free after one has purchased an NFT.’

NFT Collectors and Utility

All these forms of utility capture the attention of collectors in various ways. But, as Second Realm pointed out, artists often make the mistake of lumping collectors together in one broad undifferentiated category:

“What collectors are saying that, right? That would be my question to you. Which collectors? Is it collectors who primarily collect PFP or 10K projects [such as CryptoPunks or Bored Apes] or newer generative projects? Well then, they’re not going to be the primary collectors of 1 of 1’s. Not yet, anyway.”

“One of the things that I’ve come across is most of these newer 10k, PFP collectors have no idea the 1 of 1 world exists. They know that art exists but they don’t know how to measure it. Because they can’t look at rarity.tools and see whether or not the one that they’re buying is a better value.”

As Second Realm points out to collectors:

“I would argue that if you’re collecting NFT art, you should be investing in the person. If you’re collecting NFT 10k’s, you should be investing in the project.”

Finding Your Collectors

Identifying the difference between groups of collectors is an important first step for artists in deciding how to approach any issue related to marketing and utility. The second Realm is focused on growing a community of collectors who will interact with him daily and who will buy his art on a regular basis:

“I don’t think most artists are thinking about that. They’re thinking about how I can get as many people to buy my art [as possible]. That’s like casting a net into an ocean and hoping to catch something and you don’t know what that something is.

I come from a background where I like to know who I’m talking to while I’m talking to them. And trying to be open with them. I think that is a utility too.”

As he advises artists:

“My advice to any artist who’s worried about competing with a 10K on utility is: you’re thinking about the wrong thing!”

“You know your primary audience isn’t the same as a 10k project. Most of those are flippers. Most of those are people who are looking for an investment in the short term. 1 of 1 art is [now] a long-term game and what collectors will end up learning is they’re investing in the person. And so if that person is going to be around for twenty years, that is a more valuable asset.”

Important Points for Artists

Key takeaways from my conversation with Second Realm include the understanding that artists should not focus on collectors in general but on identifying their collectors and their collectors’ needs. One might call this Artist/Collector Fit, a variation on the notion of Product/Market Fit that emphasizes the artist over the product, and the art over the collectible. In the process, one should show collectors that one is here for the long haul while continually deepening their relationship.

“Utility” may be a prosaic term that seems to ignore the poetry of art. Yet, many of the approaches included in broad definitions of utility are integral to the path of the artist seeking commercial success. And, as Second Realm noted in our discussion if you’re not trying to make money as part of your practice of art, then you don’t need to be concerned about such notions as a utility at all.

Be Sure to Tune In for Part 2

In Part 2 of Crypto Artists and the Utility Dilemma, I will look more closely at practical examples of crypto artists employing utility to attract collectors and grow the community as well as additional observations from Second Realm.

Featured Image by Gerd Altmann via Pixabay.

Share this article:

[addtoany]