David: We are here with Steve Wand, aka BitBuzz, a legend in the NFT space. I want to talk about some of the projects that you’re currently working on, your history in the space, and a little bit about your NFT collection and what’s exciting you these days.

So maybe just to start people off, for anybody who may not be aware, how did you get started in NFTs and crypto in general; what first sparked your fire in this space?

Steve: So I started reading about Bitcoin back in about 2012. I didn’t fully grasp it; the first couple of times I read it, I had to dig a little bit deeper, and then spent like a weekend or the like, buying some, moving around, figuring it out fully. And that was really an eye-opener for me. That moment, I was like, wow, this is the craziest technology I’ve ever seen in my life. So that led me kind of pretty heavily down the Bitcoin rabbit hole.

And then I found out about Ethereum in 2014 from Ethan Bachman, who is now one of the top people at Cosmos. And Ethan said that you should take a look at this Ethereum thing, and their ICO ensues. And it’s doing smart contracts, you know, kind of different from what BTC is doing. So I did take a serious look at it and I was like, wow, this is pretty impressive. Being native to Toronto myself, there’s a lot of people that were around the area that we’re also talking about Ethereum. So it was a no-brainer to get involved at that time. And then I kept following Ethereum and saw some unique things happening with different implementations and they had, and the six versions they were implementing over two years to get launched live. And then I was at Ethereum Waterloo, which I believe took place in November of 2017 and actually, I was in the second row right behind Vitalik and his father Dimitri. When at the Shopify building in Waterloo, they hosted that, and Crypto Kitties had one of the hackathons in their Dapper Labs location.

So I was like, wow, something is going on here and I had watched, kind of from afar, Counterparty on Bitcoin, in say 2015/2016, start doing Rare Pepes and Spells of Genesis. So I could see that the actual collectibles were being tokenized on the blockchain, but no one was talking about it; no one owned them that I knew; any technical questions you asked, most people had no idea how to answer them. So yes, there were assets – but moving them, storing them, wallets, and everything else… There were none of them unless ‘some guy’ made it, and you had to trust ‘the guy’ for those assets to be stored properly, which wasn’t a very smart thing to do at that time. So it was just nice to see a smart contract platform specifically designed to handle these things come out, and when I saw Crypto Kitties I was like, okay, where you can breed these things, that’s a huge game-changer. I mean, there are parameters on the back end for future gaming, perhaps. So it was just a no-brainer to get involved in it.

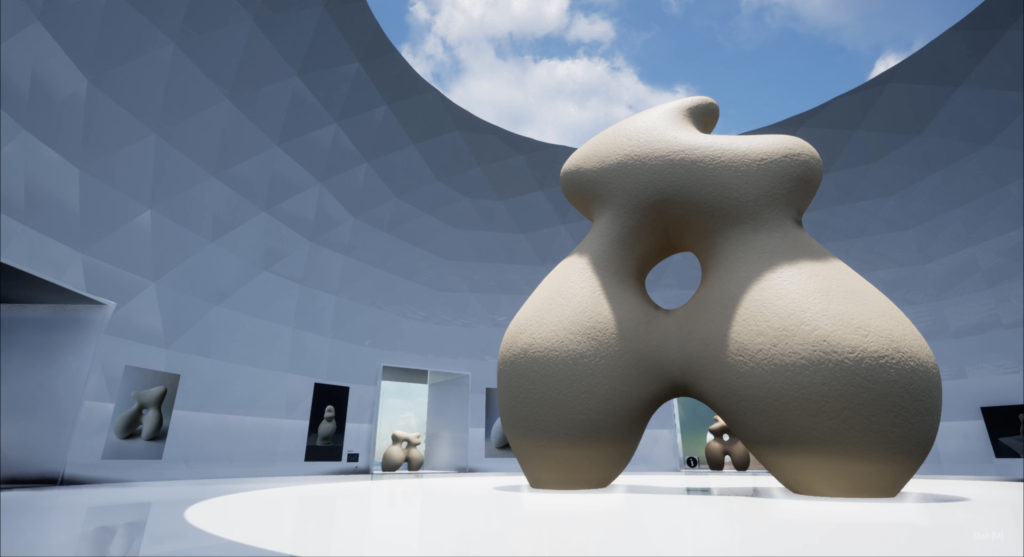

And so I started getting some early assets, buying a lot of the early NFT’s because I was buying the physical art at crypto conferences I was attending. And so when those artists started releasing NFTs, I was all over them immediately. And that kind of led me in 2018, maybe mid-2018… I found out about Decentraland and Crypto Voxels, I found them and I was like, wow, what is this? And then from there, that piqued my interest. And now I’m specifically heavily involved in the metaverse with digital fashion. We launched some wearables on Decentraland, about a year and a half ago, we were one of the first five companies to get a license to make wearables in DCL. I also see a lot of value in the VR aspect and high-quality gaming. And then with Game Credits… I also see with owning your assets, we see what’s happening with Axie and everything else. So obviously, if you give people who are playing Fortnite the other model where they could do the same thing, the same quality of content, only they can mint their own NFTs, they could put in-game that they could control themselves, and buy them at any time… That’s a huge game-changer.

So I’ve just tried to put myself in the space where when I see value in something that I’ve been waiting for for a long time… I’m gonna be like, here it finally is, it’s coming to fruition and it is live. I try to be there as soon as I possibly can, once I’ve discovered it and learned about it, so I don’t get rekt or burned by entering naively. I think that’s very important too because if I would have, my career, my path in the space would have been a lot different. Had I come in just like a wrecking ball and just grabbed things, followed the hype and FOMO and just never paid attention to what was going on, just following everyone else, I think we’d be in a different position in the space.

D: You have an incredible history in the space. So many things I want to touch on- I think, in summing up one’s past in the space, I know it’s such recent history; every time one talks about this as “history,” it almost sounds ironic, because we’re talking about the past few years. But the DeFi space that moves so quickly. So much has happened in such a short period of time, and that speaks to the exponential growth of the hyper-modern period that we find ourselves in with web3 and everything that encapsulates it.

A few things I want to talk about… We’re discussing your playbook, how things have worked for you in the space. I know you were on the NFT train so early on, and I would love to talk about some of the specifics around Waterloo, since as people may not know internationally how important a city it is for tech in Canada and internationally. But before we get into that… being somebody who was into NFTs in 2018, what would you say was the first NFT you ever bought? And was it even called an NFT, or would you just call it crypto art because it wasn’t an NFT written on a smart contract yet?

S: Yeah, to be honest, the Counterparty and Rare Pepes, which were between 2014 and 2016, and Ethereum did their own Rare Pepe in late 2016… Those were never referred to as vanity and/or non-fungible tokens or anything like that. You’d get a board; you’d buy these packs; they had parameters, so they were like a Magic the Gathering only in a Rare Pepe style, so when we were doing that, we were just trading. They were just like crypto-collectibles; that’s what we were calling them. The reason why we called them “crypto art” is that technically when you went to the conferences, no one would let you buy anything in FIAT. Everyone’s like, “I don’t want that garbage, I just want to be paid in Bitcoin.” And the funny part was, some of the artists were doing Ethereum work back in the day at the conferences, but there were still the maximalists, and it was pretty heavy back then. You would find people and artists and be like “Oh, this is cool,” you’d buy one of the BTC-themed works and you’d say like, “Okay, got any ETH stuff?” And they’d be like “yeah, but it’s like in the car,” under the table, you know? Like, why don’t you have it here? And they’re like, “yeah, some people would like to knock me for having that here.” And I was like, well, fuck that, I want to see it and so they would show me. A lot of times I would buy them, and that was Josie typically, so I was buying Crypto Kitties, I bought some Crypto Motors cars, etc.

D: Out of curiosity, when did you buy your first Crypto Kitty

S: I have quite a few Gen zeros and Gen ones, so they were brand new. They would have been like 2017 when I bought those. And then my daughter bought like 50 of them one day, too, and was breeding them and they sit in her wallet now, she doesn’t even know she has them anymore I don’t think. But yeah, Chain Breakers was out before, and the project has sold and gone away. OX universe– I brought some planets and that project collapsed and is no longer. So some of the early things just were too early. And Counterparty was just too early with its Coloured Coins. Just to give some context, Vitalik was working on a project called Coloured Coins before Ethereum’s White Paper was put out in 2014. So this was in 2013. It lays out rules for digital collectibles, and the goal was to be Mr. Hold-these-assets we were seeing flourishing on Ethereum.

I believe that back then, Counterparty was just too early. And to be honest, Next Token was not only the first haven for NFTs in 2014, for the Museum in New York you were given an NFT, that was the first one, but Next also moved to proof-of-stake three years before anyone else considered doing it. So it was an early blockchain and Next didn’t win either because it was too early as well. Ethereum came out and was big enough, was almost a standard, had hundreds of thousands of devs working on it. The first major smart contract platform to be proven and so it was just kind of a no-brainer to fall into ETH, to follow into the metaverse, into the NFTs. But for art, specifically, when I bought Josie’s stuff at a Consensus in 2018 or 2019, she said to me, “I’m going to give you a COA today for this art but in about six months, I’m gonna have an NFT ready.” And I was like, “Oh that’s fantastic,” and she’s like “Yeah, you’re gonna get them free; it’s the COA for my physical pieces.” The first two pieces I bought, you got free Josie NFTs with those as the COA. And I mean now those are worth probably hundreds of thousands, and she gave it to us for free. The second time she sold them was when you had to buy it, and if you owned a piece she would reserve it. If you didn’t care about the NFT, she would put it on the open market. They were 0.3 ETH- and ETH was maybe $150, so they were still extremely reasonably priced. So I do give Josie a lot of accolades and over the years, I’ve put posts on Twitter and a lot of other places; I do give her a lot of credit.

She was a very young, very skilled artist coming into a sea of big-headed, deep-pocketed men, which isn’t an easy task for a young woman to do who’s not proven herself yet. She came in with no holds barred, was very, very polite about it, but also could stand her ground and be aggressive when need be- which you have to give her credit for. Now XCOPY, Josie, and everyone early have seen their day in the light because they were doing this shit like 2015/2016 when no one was doing it at all. So for them to come out and set the tone with the quality standard with 24 hour auction times… I know they stepped up to take the lead on it and I know history should look kindly on them and their work should reflect those price points because they were the earliest of the early in this space.

D: I feel like more people need to know about these early days of crypto and crypto art – and what that even means – before there were NFTs. I’ve had a couple of conversations with Robness, both publicly and privately, about where he was within this Rare Pepe ecosystem and those relics that he has. I do believe in the next five years that those are going to be the things we have in museums explaining the rise in this space because they’re incredibly valuable artifacts.

S: In my mind, even with the Punks selling out now, and for anyone who knows me, I’m just not a Punk holder. I saw them when they were free, didn’t get them, didn’t have a desire to have them. I don’t like pixelated, low-quality NFT’s personally. So you can see that huge demand for them now, however; Christie’s put out an auction, or Sotheby’s put out an article that said, “We’re selling the first NFTs ever,” so there’s a huge misconception in the space. A lot of newbies think Punks and the reason for their value accumulated over the years, because of this “first NFT thing” that’s a blatant dis-truth. They’re like the seventh or eighth project, we’re finding out about more and more every day. Right now, because they weren’t ever obtainable, or no one wanted them, they weren’t in demand until they were wrapped; because of the standard, they couldn’t be traded easily on Opensea. The second that you’ve got Rare Pepes, Spells of Genesis; when those assets could be moved freely wrapped with BTC, traded on Opensea in metamask wallets or whatever elsewhere we all use and want, then those are the true holy grails of this space.

I think that the people now grabbing Punks are the new DeFi Whales that don’t know and weren’t around to see those things get to their fruition. So they just grabbed Punks because they were told that those were the first. These other assets are so much rarer and so much more valuable, like the Spells of Genesis Satoshi cards… there are 30 of those in the world. Some of those Homer Pepes, and Token Angels, all of those- and people are passing those up right now and spend like 7 million on a Punk. Well, you could probably go buy 50 Rare Pepes, which I think in 10 years are going to far outweigh in value and just scarcity. If we are playing the game of what’s the first, what’s the rarest? All those are 10 times rarer than the Punks; there are 10,000 Punks, there are not 10,000 Rare Pepes.

POST YOUR FIRST #NFT, I WANNA SEE EVERYONE ELSE'S, TIME FOR SOME REFLECTION.

I'LL START.

'SATOSHICARD' FROM SPELLS OF GENESIS(2015) pic.twitter.com/9JuRcHmUyt

— MC ROBNESS (@ROBNESSOFFICIAL) September 1, 2021

D: I think that’s important to talk about and I think that these kinds of conversations need to be had. People enjoy the “crash course,” the quick introduction, but the more people look into NFTs the more people learn about NFTs; you have to go back, and when you realize how far back you can go, that’s when you can learn more.

So you’re talking about Counterparty, you’re talking about some of these early platforms… Another thing that I think is interesting, which is a little bit of fun as well, is SuperRare and MakersPlace, I believe, call themselves the first marketplaces. What do you think about that? And to you, what is the first NFT marketplace?

S: So there were art markets before that, and some of them don’t exist any longer. They again were too early, like Async Art was too early. It’s going to see its light in the future when people realize what they can do with it and Async was there the whole time waiting for them just to come with their knowledge and skills. Async is fantastic, they’re so undervalued, so under-talked about, and so underutilized. Once artists realize what they can do on Async, Async will be like a SuperRare as well, easily. So will Mintbase. Mintbase is fantastic and it’s a sleeping giant in my mind. But SuperRare was the first that got like Whale Shark, Token Angels, myself, Pablo, we all started going on there.

So SuperRare was the first one where there was a social aspect where you talk on Twitter, and then go outbid each other on SuperRare. That wasn’t happening on other platforms before that, because there weren’t enough of us, there were like four people doing it. So now there was like, 50 of us all doing it and we all got to know each other, just organically because we were beating each other and we were buying each other’s work. You’d be like, “Oh you outbid me on that, that’s such a beautiful piece, congratulations on winning.” Where now it’s different, it’s a lot more diluted. When I saw OpenSea, I was like, “Oh my God, I found it.” Now, there wasn’t the ability to put physicals on there, but I believe, not OpenSea, but other entities will soon be launching an OpenSea and crossing over with eBay where you can do digital and physical items if it has to be done. I know a few people who are actively working on it for months now. So that’s only a matter of time before that comes to fruition and then not like OpenSea’s going to lose out because we see the number of wallets being opened and the amount of daily user activity is disgusting. It’s growing; I mean if that continues, that’s mass-adopted very, very quickly, the chasm has been crossed already.

So in this space, like I always said to business partners, OpenSea is the new Amazon, it’ll be a trillion-dollar company very easily. Now, I just don’t know, if you look at my Twitter and socials, this space was functioning fine with 100 of us trying to do it, now there’s 10,000 of us trying to do it and a whole bunch of VCs knocking on the door with their pocketbooks open. I don’t believe we need them. Things will get fast-tracked with their money and paying devs but it also skews at the end goal. And if you’re outvoted and ousted from a company, it doesn’t matter anymore, you have no say at all. So as much as it’s nice to get VC money, the Mark Cuban’s of the world coming in, I believe OpenSea is going to start KYCing if they do an Airdrop.

So it will taint the space and if you’re truly into this space for decentralization, and why I got here fully, then things like that turn me off, no offense to Nifty, they’ve done a fantastic job, bring a lot of eyes in the space of blowing up a lot of careers. The second they ask me for my ID, I won’t be using Nifty moving forward. I removed all my “for-sale” items and moved them all off Nifty. I’m in this space so I don’t have to abide by those things- you’re going to come full circle and mandate that we’re doing the same thing as you know, TD Ameritrade would make me do, I know, that’s when it stops being a crypto company in my mind.

This is part 1/3 of my interview with Bitbuzz- Stay tuned for Part 2 this coming Monday!

In the meantime follow Steve on socials and check out some of his current projects:

Bitbuzz on Twitter, Clubhouse, Instagram

Not Fungible: https://notfungible.com/

Game Credits: https://gamecredits.org/

Digitible: https://digitible.com/