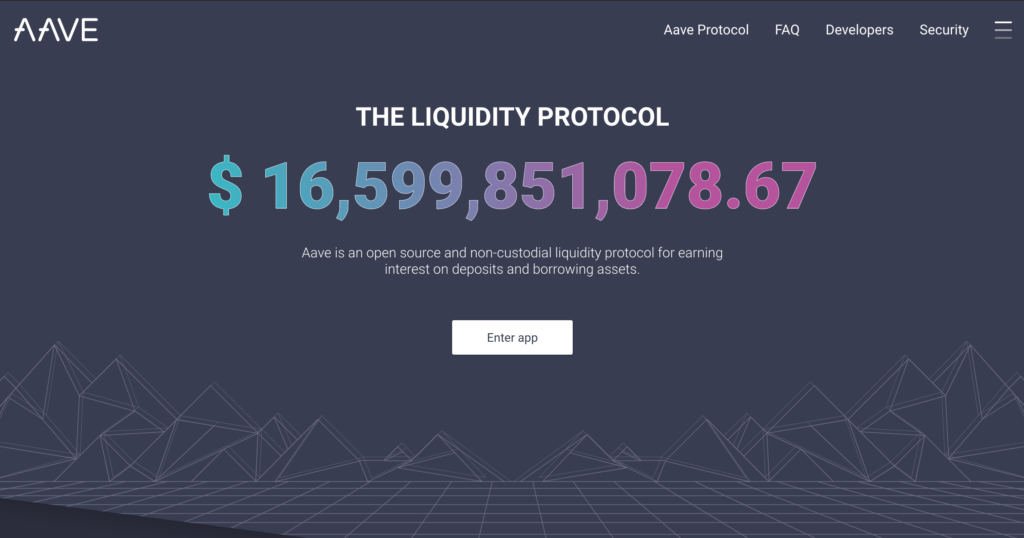

As the world continues to familiarize itself with decentralized currencies and the concept of NFT’s, we are simultaneously presented with a wide range of possible applications associated with them. Remember, when people were denouncing the credibility and functionality of NFT’s? Remember that last piece I wrote on NBA Topshot? Well, very soon you’ll be able to take that very same Zion Williamson NFT I mentioned prior and use it as a security for collateral. As if earning “interest on deposits and borrowing assets” wasn’t akin enough to an FDIC-insured bank, AAVE has taken further steps. AAVE’s latest development in the world of DeFi is the opportunity for its users to use their NFT’s as collateral, as stated by their CEO Stani Kulechov.

(Image Credit: Aave)

We don’t have very much information as this is all very new, however, we should discuss what this means for the crypto community at large. Using valuable assets has always been a means of establishing net worth. Acquiring a home or car, applying for a loan, or in place of bail or bond in a courtroom. What if you had the option to add digital assets to the equation? The mere ability to do so would absolutely be of major financial assistance to artists in any foregone situations. Nonetheless, this goes much deeper. I’ve included images and quotes from various community members with opinions to illustrate what the average persons’ perception of NFT’s might be. (adam22)

A financial institution with as much notoriety in the crypto world as AAVE backing NFT’s so much that they are willing to allow users to put them up as collateral against something like a house is a major statement in favour of their potential value. At this point in time, a majority of people still do not understand cryptocurrency, even less appreciate NFT’s, and less than that would buy them. AAVE’s next move could be the catalyst for people to start informing themselves. Think about how simple it would be for a rich individual to acquire an NFT to store his asset’s, simultaneously making the artist’s career. Similarly, an individual with a more average bank account could easily acquire an NFT and allow it to balloon into something more monetarily valuable, then later use it as collateral.

Think about how difficult it was to pitch to your parents that you wanted to be an artist. Consider the effort involved with fighting to get people to take your art more seriously. In the traditional art world, we’ve seen illustrious works of fine art used as backing for collateral, this isn’t even uncommon. With AAVE backing you, your parents who grew up before the internet was conceived are given good reason to have faith in your craft. When AAVE implements this feature, there will surely be more crypto institutions of similar sizes who follow suit. This just means more credibility to both the concept and the artist. In other words, AAVE’s soon to come collateral system doesn’t just back your NFT or the home you’re looking to buy. Before all of that, it backs you as an artist. We’ve had enough polarity in this genre of digital art, and this may very well be the solution. Funny enough, both collectibles and fine art can be accepted as collateral, and an NFT can arguably be classified as both, but certainly can be at least one. it’s honestly strange that this hasn’t happened already.

I love DeFi and a good NFT as much as you the reader likely do too, but to be taken seriously we must consider the opposing perspective, not just bash them. What happens when you put your piece up for a collateralized loan and it’s value depreciates? Here’s an easy example to follow: you’re a young collector who purchases a collectible pack from NBA Topshot. You score a one of a kind piece featuring Lebron James dunking on Steph Curry. You then take said NFT, and put it up for a loan for 20ETH. The following month, Lebron dunks on Curry again, and somebody else purchases that minted moment. Does your NFT’s value effectively get cut in half and leave you stuck to pay off an enormous debt you can’t possibly pay? It will be interesting to see exactly how something backed by DeFi will hold up in the long term against something with a somewhat fixed or a more fungible value.

In conclusion, while there is only room to speculate on AAVE’s NFT collateral system, I can say with the utmost confidence that the benefits heavily outweigh the negatives. As the universe surrounding NFT’s grows more roots, it will be easier to say how things will branch out. That being said, as the days grow closer to bringing this concept to life, I postulate that speculation will grow with it, especially as the story accumulates more media attention. The success of this feature seems to be incredibly pertinent to inciting the range of potential positives I mentioned earlier in this article. I have no doubt that AAVE will get this right from the beginning as a lot is dependant on them. What happens from here remains to be seen, however I’m looking forward to using my own artwork to create a stable future as well.