The blockchain never stops working. The Ethereum network verifies and records millions of transactions from thousands of DAPPS every day. Each cryptographically signed transaction is validated, timestamped, and stored in a chronological chain of blocks. Every 14 seconds, a new block of transactions is created. It’s impossible to manipulate or delete the data because the block “chain” would break.

1.1 million or more transactions are processed each day on the Ethereum blockchain alone, and record-keeping is public. This means anyone can explore, examine, and investigate the Ethereum digital ledger 24 hours a day, for free. You can help yourself to a wealth of information if you know how to look, because anyone can see everything everyone is doing. With that in mind, consider that every fraudulent, unethical, immoral, and criminal transaction that has ever occurred on the blockchain literally happened in plain sight.

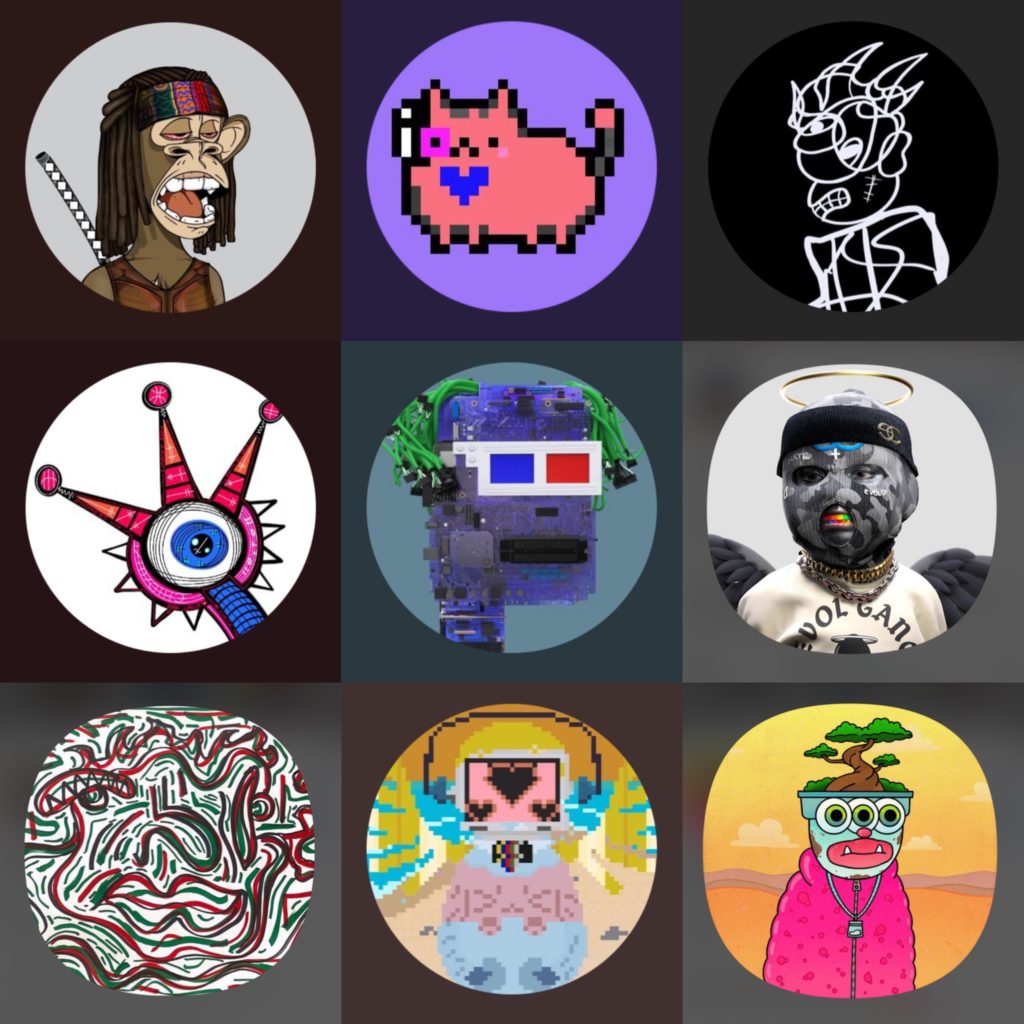

Degens are both night and day traders of NFTs; always on, always working, just like the Ethereum network itself. This casual group of self-proclaimed degenerates has a sleepless ambition in common, which requires a tireless on-chain presence. Unlike large financial institutions, brokerages, and trading houses on the stock exchange, transactions on public blockchains are most often executed by individuals who reference market resources, lists, analytics tools, and their collective instincts and intuitions. Degens gamble with assets in a gamified way, in a friendly real-time competition. They relish volatility in the market because any NFT can be attractive if its price fluctuates often, or dramatically, on a given day. Along with a shared appreciation for NFT art, PFPs, and other collectibles, Degens often work together to capitalize on market inefficiencies and profit from price changes.

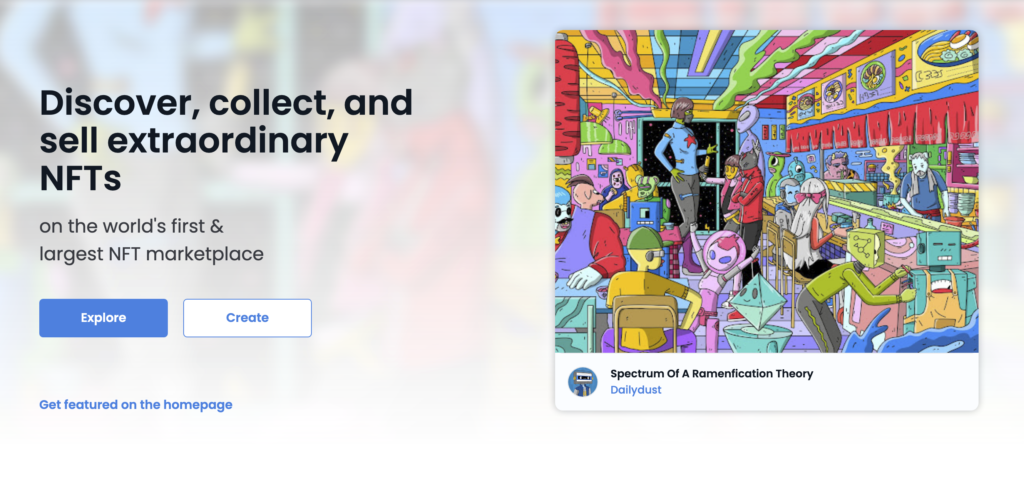

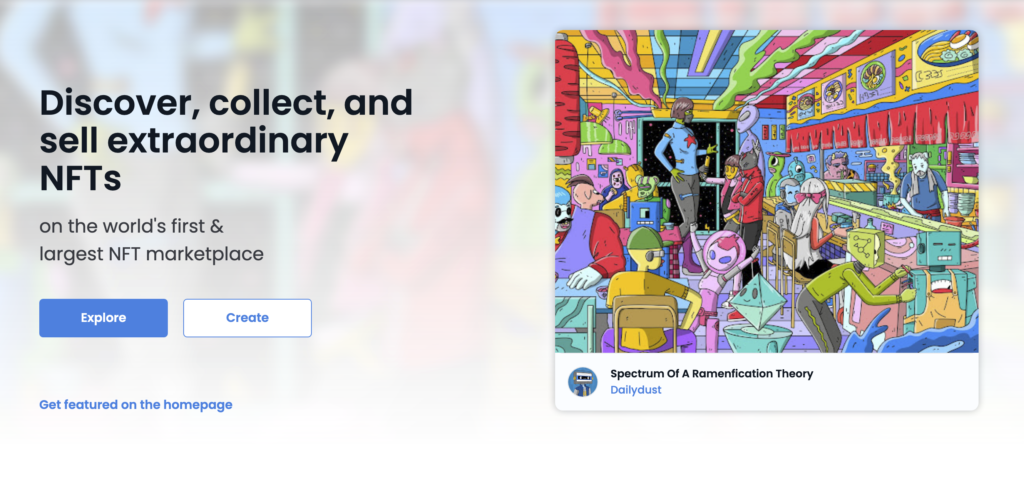

Late one night, Direvice and Prez were doing their normal ‘degenning’ on OpenSea’s marketplace. It’s widely known that when an artist is featured on OpenSea’s front page, the coveted effect is a boost of sales that results in most if not all of their art selling out. The perceived value of the art can also increase as much as tenfold overnight. The ripple effect of getting featured on OpenSea spills over into sales of the artist’s work on other marketplaces and even blockchains. You have officially arrived as an artist when OpenSea features you because it is the largest NFT marketplace with 1.6 million NFTs sold last month alone. Degens and other non-fungible flip artists park and refresh OpenSea’s front page constantly. So the first wallet to snag an NFT by a featured artist before its value skyrockets often belongs to a Degen.

“When the home page turned to Harry Pack, me and Dire jumped on it to try and snag a Harry Pack right away,” Prez recalled. Unfortunately, they both missed out on the chance to buy four Harry Pack NFTs, which surprised them both. Knowing their refresh game was on point, something didn’t sit right with Degens, who are used to winning.

“There was one wallet that had two of them, another two wallets had one each of the four that were listed. I was like, wait a second, how in the heck did somebody get like 2 of these, and two other people got one each, and we didn’t even get one, and we were so quick–this doesn’t make sense.“ Direvice said.

Degens tried to let it go, yet because Degens never sleep, their sleepless curiosity became a waking obsession. “I was like, you know what? Who is this dude?” Direvice wondered. “So I dug into his wallet, and I figured it out.”

The wallet revealed an unscrupulous routine. Transactions document an ongoing scheme to buy artwork by an artist within minutes of that artist being featured on OpenSea’s homepage. Each time this happened, the wallet would first send crypto to other wallets without any other crypto or NFTs already in them. Then those wallets would buy the art before OpenSea featured the artist on its homepage. As soon as that artist was featured, each wallet sold the art it had just purchased. “When you catch the OpenSea homepage, that’s like an automatic 10x,” Prez said regarding the price of a featured artist’s work. After selling the art and getting paid by OpenSea, the wallets sent their crypto back to the one and only wallet that funded them all. This despicable practice went unchallenged and unchecked for 80 days; Degens tracked everything back to the day Gabe Wiess was first featured on OpenSea’s homepage.

To support their research and discovery, Degens made a video. They also have pictures of the wallets involved and every blockchain transaction. “We were trying to figure out the best way to go about it, like whether we should go to OpenSea directly, or like, just blow it up ourselves,” Prez said. “We didn’t know which way to actually do it.” Finally, they decided to seek help from a colleague in the crypto community, and that’s when the results of their investigation leaked.

Unmasking a Punk

In a decentralized crypto community, there’s absolutely nothing wrong with anonymous identities. As much as it is problematic, it’s also an accepted norm. Anonymity is even more prevalent among wallet holders, which is safer and more secure when you’re touting a motherlode of crypto. However, decentralized anonymity makes shady deals easier to make, crimes more challenging to prosecute, and scam artists and predators virtually impossible to identify. Yet mistakes are made on the blockchain every day, and bad actors are often careless. Many of them aren’t calculating enough. Some of them rely on the fact that most people simply aren’t paying attention. Like the front page scandal at OpenSea and every other scandal known or unknown, transactions occur in plain sight, right along with everything else on the blockchain. It’s important to note that buying and selling NFTs isn’t regulated by the Securities and Exchange Commission. What makes this OpenSea scandal noteworthy and unusual is that a suspect was identified by Degen due diligence. What makes this fascinating is that the trail of deceit quickly led from a seemingly anonymous digital wallet straight to its owner by way of one of the most popular, iconic, scarce, and visually recognizable PFP collections in NFT history.

“I was like, I know who this CryptoPunk is,” Direvice exclaimed. “We were trying to buy this stuff to flip it and make the same crypto he made, but he’s first in every one of these OpenSea front page buys because he’s the one who puts them up,” Direvice said.

“It’s universally known that if you have one of those, you know that person associated with it too,” Prez said. CryptoWizard agreed. “When I was first getting into the space, I’d see someone had a unique PFP, and I would just go in the collection and put in like three of the obvious traits in the search bar, click, there it is, that’s their wallet,” CryptoWizard said. “I assumed people would be doing the same to me. It’s an open ledger. Get used to it.”

OpenSea immediately implemented new policies regarding team members who “may not buy or sell from collections or creators while we are featuring or promoting them” and are “prohibited from using confidential information to purchase or sell any NFTs, whether available on the OpenSea platform or not.” Nate Chastain has since resigned.

Share this article:

[addtoany]