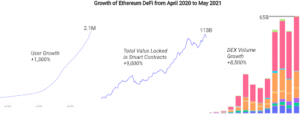

DeFi or Decentralized finance is more than just a new financial technology that is re-imagining financial services and infrastructure, it is a movement that has come a very long way since the early days of raising funds via an ICO (Initial coin offering). We are seeing the world of DeFi merging with NFTs via incredibly interesting NFT projects like Charged Particles that bring DeFi functionality to NFTs.

The very idea that financial services could operate and function at a global scale without the traditional financial institutions and middlemen in full control was only a dream not too long ago. Made possible by the rise of blockchain technology and smart contracts, first pioneered by Ethereum, Bitcoin’s super nerdy high tech cousin.

Uniswap has held the top spot for Ethereum based decentralized exchanges with over $8.4 billion in TVL (Total value locked) which is a metric for describing the total assets locked, deposited, stored, sent, lent and provided by a DeFi protocol or exchange.

For those who don’t already understand what a decentralized exchange (DEX) does, essentially, it is a cryptocurrency exchange that allows for direct peer to peer transactions that are both secure and do not require a trusted third party like a bank, stock broker or government institution, that needs to hold custody of your funds to facilitate transactions.

In other words you have to send your funds to a central party like eTrade or Robinhood in order to trade and exchange with other users on those centralized financial exchanges.

Decentralized exchanges reduce the risk of theft from hacking centralized honeypots because the DEX does not hold the funds, the users hold their own funds in wallets they control.

According to glassnode In just 8 months DeFi has attracted over $100 Billion into smart contracts like Uniswap, and of the 2.1 million users who have interacted with Ethereum based DeFi platforms 1.53 million have used Uniswap.

Img Src: https://insights.glassnode.com/defi-uncovered-the-state-of-defi/

Uniswap has been wildly successful since they pioneered automated market makers (AMM) back in November of 2018. They have paved the way to removing the massive dominance and influence of hedge funds as the market makers, exchanges and clearing houses.

The new version 3 upgrade that Uniswap has released is being received with mostly positive signals, depending on who you ask. According to Jordan M. Schuster of Expaaand.com he says “It’s an innovation on one hand, but a complexification on the other.”

As if DeFi was not already confusing and complex for people unfamiliar with this insanely technical space. Schuster adds” Uniswap is the AMM market leader, but they’re getting a ton of friction from Pancake Swap and BSC which always seems very agile in making the UI more fun and easy to use. Every Ethereum project has a huge hurdle to cover regarding gas fees. Sure the next Layer 2 deployments may offer significantly lower gas fees for a broad range of transactions, but currently it’s a minefield.”

So what are some of the major new features Uniswap is bringing out with V3?

- Concentrated Liquidity

- Multiple fee tiers

- Range Orders

- Advanced Oracles

- New Software Licence

You can read the full break down here on Uniswap’s blog

Joseph Crivelli of Cloud Fire Capital, a digital asset hedge fund exclaims “Uniswaps concentrated liquidity upgrade for V3 is one of the most important improvements in all of DeFi” and goes on to state that “ This will legitimize the infrastructure that powers the Defi ecosystem, which will lead to an uptick in institutionalized adoption in this space. We are beyond excited to watch the roll out of V3 and the evolution of the industry as a whole”

Attracting new users is quickly becoming the most important aspect for a DeFi protocol and according to DeFi Llama, Pancake Swap on the Binance Smart Chain is actually ranked number one with the highest Total Value Locked at $9.3 Billion.

This coincides with my interesting conversation with Jordan of Expaaand.com on this subject, who said that “Ultimately Uniswap V3’s success will be measured in relation to Binance Smart Chain, the fact that BSC products are more youthful and engaging to the new oncoming population of crypto enthusiasts (from NFTs to DeFi). There’s starting to be a clear culture divide between the richer westerner OGs who prefer Ethereum products, to younger culture driven apes, who love BSC products.”

There is a conversion of the old financial world and of the new more open decentralized paradigm and it is often reflected in different age groups and the length of exposure to cryptocurrencies. There are many maximalists who believe that only Ethereum based DeFi products really matter, but I can think of 9.3 Billion reasons to say this may be a misplaced notion. As younger generations of “retail” investors, some fueled by the Wallstreet Bets sentiment are moving where there is less friction and at this point in time, that is the Binance Smart Chain, at least until Etherum can get its gas fee problem in order.

The other aspect to this new V3 upgrade to Uniswap is that it does introduce additional options and complexities that will attract more sophisticated users and liquidity, while possibly also pushing the less sophisticated newbies away. The new features will better incentivize staking activity, which does improve liquidity for Ethereum transactions and “This could be really really helpful for NFTs on a lot of levels” Schuster mentions.

Outside of the new features being released in Uniswap V3, one major talking point is the new Business Source License (BSL) 1.1 for its code, which is attempting to prevent what happened with previous versions of its open source code, where savvy competitors like Sushiswap were able to copy and siphon off a large amount of liquidity from Uniswaps user base. While competition is healthy in this space, if you go to Uniswap.com you will actually be going to a competing exchange called Sushi swap. You may call this clever genius, funny or even underhanded, you decide.

Uniswap is trying to give their community a head start with its new code base by restricting use for the first two years before the license expires and becomes a GPL 2.0 open-source license.

Speaking with another incredibly intelligent voice in the DeFi space, Allen Henna a DeFi and digital assets consultant shared “It will be interesting to see how Uniswap V3 does with moving into the territory of Curve Finance. That battle will be interesting. I also look forward to seeing how far Uniswap can get out into the market with their new license being forked and new competitors taking them on like what happened with SushiSwap.”

Ultimately, it is yet to be seen how the new license will work in reality. One interesting fact is that the Uniswap community itself can revoke this license or make it expire sooner. There is sentiment in the community that trying to enforce a copyright against anonymous developers will be useless. However, remaining anonymous is incredibly difficult, even if you read Edward Snowden’s books 16 times and take notes.

1/ One interesting piece of Uniswap v3 is its use of Business Source License (BSL) 1.1, which restricts production use for two years.

I see people asking if @Uniswap can really use BSL 1.1 against v3 forks. Answer: yes, mostly, at a cost.

The DeFi + copyright situation 👇 pic.twitter.com/KYQZTl58Ht

— Jake Chervinsky (@jchervinsky) March 24, 2021

Uniswap has been a clear leader in this space and this next evolution with V3 will add new functionally, possibilities as well as some complexities, that will all force the rest of the DeFi ecosystem to react. Competition here is great for all of us, as the true winners will be those who learn the ropes of DeFi and ride the wave of a new decentralized financial future.