Anyone who knows anything about GaryVee probably knows that the Chairman of VaynerX and CEO of VaynerMedia is a savvy and relentless entrepreneur. Despite the technical difficulties that delayed the launch of his first NFT on May 5th, a galvanized community of friends, fans, and followers are eagerly awaiting his “VeeFriends” drop. For 15 years, GaryVee has interacted with, inspired, influenced, and informed hundreds of thousands of people about trends and patterns in consumer behavior. His genesis NFT collection was borne out of the idea that business with friends around common interests can be fun. VeeFriends is an interactive roadmap to create value and access for on-chain communities, with NFT blockchain technology paving the way.

“When you think about what he’s doing, this is going to be the first of its kind–not the first event ticket, but it definitely is the first conference ticket, and what GaryVee is providing outside of that, a community around the access tokens, is something that a lot of people haven’t been thinking of yet,” said Dave Curry, known to the NFT community as Black Dave, an artist and thought leader on the blockchain, decentralized systems, and DeFi. A total of 10,255 tokens will be released, consisting of 9400 admission tokens, 555 gift goats, and 300 access tokens; including many one-of-ones. Each artwork characterizes traits that GaryVee believes in and champions, and rather than simply auctioning off an NFT, every VeeFriends token also includes a smart contract that gives it “utility” through metadata.

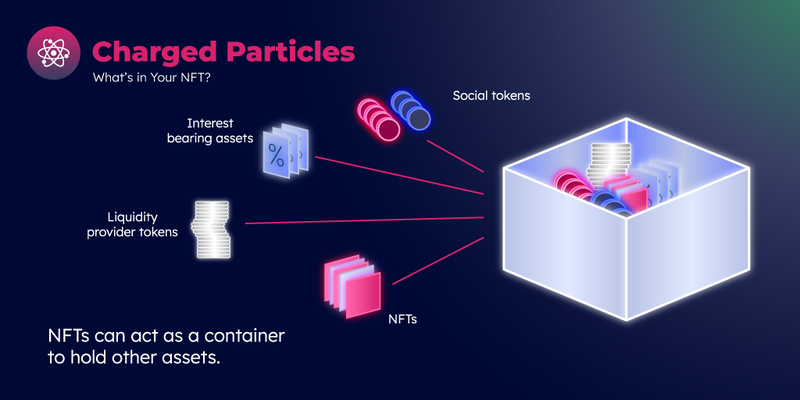

“My first thought is that this is genius,” said Ben Lakoff, Co-Founder of Charged Particles, a protocol that allows users to deposit any ERC tokens into any NFT. “GaryVee has a very vibrant community and followers. There’s this new world I see coming, and it’s some confluence of NFTs, social tokens, and people interacting with their fans and communities in new and engaging ways, and I think GaryVee is rolling it all up into something new. It’s fantastic, and I think it’s good for his community as well as the NFT community,” Lakoff remarked. VeeFriends tokens include a three-year access pass to attend VeeCon, a new multi-day GaryVee event in 2022, 2023, and 2024 focused on business, marketing, ideas, creativity, entrepreneurship, innovation, competition, and of course fun. Friends of GaryVee will enjoy group hangouts, leisure activities, games, sports, brunches, dinners, and surprise gifts hand-delivered to their home.

Since the new year began, the NFT market has been flooded with new and established artists, opportunistic celebrities, reactive brands, quick-pivoting athletes, and influencers of all kinds attempting to cash in, and cash out. Conceptually, a shortage of ingenious applications for purposing NFT smart contracts by design is as apparent as the blockchain is transparent, with very few high-profile drops that look, feel, or function entirely unlike anything we’ve already seen before. Among the likes of GaryVee, however, a mindful group of pioneering trendsetters are carefully considering their genesis pieces.

“GaryVee has been talking about blockchain for years, so you know what you’re talking about when you’re a blockchain OG,” said Black Dave, who has become a trusted figure and resource for the burgeoning NFT community in NFTs.tips rooms on the Clubhouse app. A self-proclaimed GaryVee fan for at least a decade, Black Dave used to follow GaryVee on Youtube. “I think he was waiting for the right amount of attention to be in the space because his whole ethos is about focusing on where attention is and not trying to bring attention to things. You kind of get a pass to get into NFT’s anytime you want because we know that you’ve been taking blockchain seriously.” Black Dave said. GaryVee purchased $25,000 worth of Bitcoin in 2014, and by 2017, he was already telling a news channel that the blockchain could overthrow America, China, and Russia. GaryVee has been championing Ethereum and NFTs ever since—including CoinGeek Live where he discussed the emergence of on-chain social media platforms last year. This year, GaryVee was featured with multiple guests in a panel discussion on the future of NFT collectibles at NFTHack, a weekend summit powered by ETHGlobal.

“I know there’s a lot of cash grabs and people jumping onto this bandwagon because it’s hot, and it’s the cool thing to do, but I know Nameless.io by NFT42.com, and the project GaryVee chose to collaborate with is well respected in the NFT space. I think it makes a lot of sense if GaryVee holds his end of the bargain, and continues to recognize these token holders and the value they provide within his own world that he has created,” Lakoff said.

Consumers can purchase VeeFriends tokens using ETH (Ethereum) through a non-custodial digital wallet of their choice via Dutch auction. The sale of VeeFriends tokens has been set up to accept payments from MetaMask, Portis, and WalletConnect compatible digital wallets. A Dutch auction will start the sale of each token at its highest set price; instead of bidding up, the selling price goes down. Consumers can buy a token at any moment, or wait for its price to be incrementally reduced until the token ultimately reaches its price floor if it is yet unsold. VeeFriends tokens will start at 3ETH and go down to .5ETH per NFT. Relatively speaking, GaryVee’s 2018 immersive consulting sessions known as 4Ds (Daily Digital Deep Dive) were selling for $12,000 per seat in March 2019. That’s about the same price as 3ETH right now. For context, over 350 alumni have been through GaryVee’s 4Ds program in New York, Los Angeles, Miami, Chattanooga, and London.

“I think it’s interesting that GaryVee is letting everyone set their own price for entry into the conference because, with the Dutch auction, the price will drop lower and lower until all the tokens are sold out, just like the Meebits did last week. What’s interesting is that VeeFriends tokens are for three years. If I attend VeeCon 2022 and it’s absolutely insane, that increases the hype for VeeCon 2023, bringing added value for 2023 and 2024 token access. But if the conference is less than stellar, there’s a possibility that if someone doesn’t want to attend, they may potentially be selling on the secondary market at a loss,” Black Dave pondered. This sets a level of expectation for GaryVee and his team to exceed in curating nostalgic experiences for VeeFriends token HODLers. “I have always been about building businesses and creating value for my community, and this NFT project allows me to do both,” GaryVee noted. In addition to 108 one on one access tokens for sale when VeeFriends drops, five free scholarship tokens will also be distributed for access and mentorship from GaryVee and his professional network.

“One reason why GaryVee was gonna release his first NFT on May 5th, five-five, is because that’s his favorite number,” notes Craig Wilson, a writer, filmmaker, and sports cards collector. “If you’ve ever seen a selfie of GaryVee with somebody, and he’s putting up five fingers, now you know. I forget the reason why his favorite number is five, yet that’s interesting synchronicity right there,” Wilson noted.

Some days Wilson listens to GaryVee in his ear for hours on end, or on his television while doing other things. “GaryVee speaks to me in a way that a good band does with great lyrics or poetry. I relate on so many different levels. I’m looking at sports cards, working on my own collectible NFT, multi-tasking, washing dishes, just like people do in NFT rooms on the Clubhouse app,” Wilson laughs. He has been looking forward to GaryVee’s first NFT release and recalls his mentor’s advice about standing out in a crowded NFT market. Wilson wants his own NFT collectibles to tell a story, with a puzzle embedded in their design.

“At this point in my life I just want to work with my friends or people I love, so I feel the same way GaryVee does about my own journey as an artist and content creator. GaryVee has spoken about this a lot, because he believes that in the future, NFTs will be kind of like social media, and you’ll look at someone’s wallet, and notice, ‘Oh, you were at VeeCon22? I was there too!’ and you’ll know you’re bonding with a like-mind,” Wilson muses. This is how VeeFriends are made.

Share this article:

[addtoany]