Popular NFT brand, Bored Ape Yacht Club, is in talks with venture capital firm, Andreessen Horowitz, to lead a funding round of about $5 billion to raise their valuation, according to the Financial Times. The deal is still a work in progress as no terms have been agreed upon but will surely be one to watch out for.

Although BAYC has yet to comment on the negotiations officially, they have previously said they plan to create a strong brand and hand it over to the community. Another source, NFTNick.eth, told his Twitter followers that this would likely be huge for the NFT industry as it will validate the NFT business model if this deal comes to life and the news gets out.

Crypto companies generally utilize funding to expand their businesses and scale their operations globally. For example, back in 2013, When Coinbase was valued at $143 million, it received about $20 million in funding from Andreessen Horowitz. It is currently valued at $86 billion. Even successful brands like BAYC require external funding to grow faster than what investments from their own profits can achieve. BAYC receiving VC funding will allow the brand to expand its business, and you will expect its valuation to increase in the future as the demand for BAYC NFTs continues to grow.

Bored Ape Yacht Club, a collection of 10,000 uniquely generated cartoon images of ape NFTs, went viral in 2021 even before prominent celebrities like Eminem, Stephen Curry, and Jimmy Fallon, amongst others, bought them. The frenzy does not end with merely acquiring a Bored Ape NFT, as ownership connects you to many celebrities and popular influencers who are members of this club. The number of celebrities ‘aping in’ is increasing every week.

Bored Ape NFTs, which were minted on the Ethereum blockchain, has recorded more than 393,000 in trading volume and have at least 6300 owners on OpenSea, with the lowest priced Bored Apes selling for about 18.5 ETH at the time of writing. Yuga labs, the team behind BAYC, has remained committed to growing the BAYC brand even further, and this potential deal with Andreessen Horowitz is a testament to their resolve.

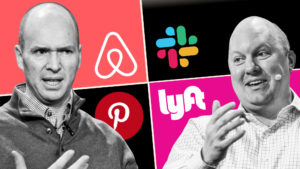

Who is Andreessen Horowitz?

Andreessen Horowitz is an investment company based in Silicon Valley, California, founded by Marc Andreessen and Ben Horowitz in 2009, commonly known as A16z. The company has more than $28b in assets, with investments spanning from Crypto and Fintech to Healthcare.

A16z invests in companies across different stages of growth, from seed to startups, mid and late stages. They boast of a strong track record of having backed highbrow companies like Coinbase, Airbnb, Github, and Slack, transforming the then small businesses into giants.

A16z are not newcomers in the crypto space. In June 2021, the company announced a $2.2 billion fund to invest in crypto founders, teams, and networks. In addition, the Financial Times reported on plans by Andreessen Horowitz to raise more than $4.5 billion for crypto investments this year, doubling last year’s figures. A16z has been investing in crypto since 2013 and has shown interest in decentralized finance, Web3, creator funds, and the next-generation payment methods.