Paris has always been at the forefront of cultural movements, so it’s no surprise that it’s become the home for “the largest annual European Ethereum event focused on technology and community.” This week, the “city of lights” is playing host to the fourth annual Ethereum Community Conference ( EthCC [4]) with a series of exciting speaker series, workshops, and networking events focused on scaling and amplifying the Ethereum network.

While Bitcoin has been in the “mainstream” since at least 2017, 2021 could very well be dubbed “the year of Ethereum.” Both DeFi and NFTs are responsible for this growth, with banks and major corporations rushing to claim the title of “pioneer” within the blockchain space. On the first day of EthCC [4]: DAOs, DeFi startups, new protocols, and established blockchain companies were set up throughout the sprawling Maison de La Mutualité. All of these projects presented are part of the Ethereum ecosystem and help developers and builders find the tools necessary to their decentralized objectives. Companies on-site included Boson Protocol, AAVE, Paraswap, Hermez, Celo, and the Stake DAO.

On the first day of the conference, there were many conversations in conference rooms and hallways alike about tokenization, smart contracts, cross-chain solutions, and derivates. There was also lots of talk on the subject of NFTs, one of the star applications of the Ethereum network.

From Charged Particles to presentations by digital art advisor Fanny Lakoubay, here are some of the NFT highlights from Day 1 of EthCC [4].

STATE OF THE MARKET FROM NONFUNGIBLE.COM

It’s hard to believe that the mainstream buzz around NFTs began only four months ago. In that time, there have been record-breaking sales, countless meme mintings, and numerous news articles proclaiming that NFTs are dead.

Beyond speculation of where the market is going, the numbers show that NFTs in the form of collectibles and digital art assets are still a very promising market. According to data compiled by www.nonfungible.com, there have been more than 200,000 sales during June of 2021, with collective revenue exceeding $224 million USD.

Collectibles continue to lead sales, accounting for almost 66% of the total NFT market, while art NFTs only account for 14% of all total sales. NonFungible.com co-founder Gauthier Zuppinger presented this data at the conference.

While the market is not as bullish as it was in March, it’s likely this fall will see a plethora of new projects, which will potentially bring in entirely new collectors and revenue to the space.

ART MARKET CASE STUDIES FROM FANNY LAKOUBAY

Insight into French public opinion was delivered by New York-based digital art advisor Fanny Lakoubay. While many traditional institutions have yet to embrace or see value in utilizing NFTs, many auction houses (Sotheby’s, Christie’s, Bonhams, Phillips, Cambi) have leaped into the space. It’s also interesting to note that a handful of museums are also experimenting with NFTs. There have been NFT projects from the Italian museum Le Gallerie Degli Uffizi, The Hermitage, and The Whitworth at the University of Manchester.

In addition to showcasing how NFTs have affected the traditional art market, Lakoubay also highlighted some leading marketplaces in the ecosystem. These included permissionless platforms such as Open Sea, Rarible, and Hic et Nunc; invitation-only platforms like Foundation, Super Rare, Makersplace, and Known Origin; and curated platforms such as folia, blank, palm, and snark art.

CHARGED PARTICLES MAKING NFT WALLETS

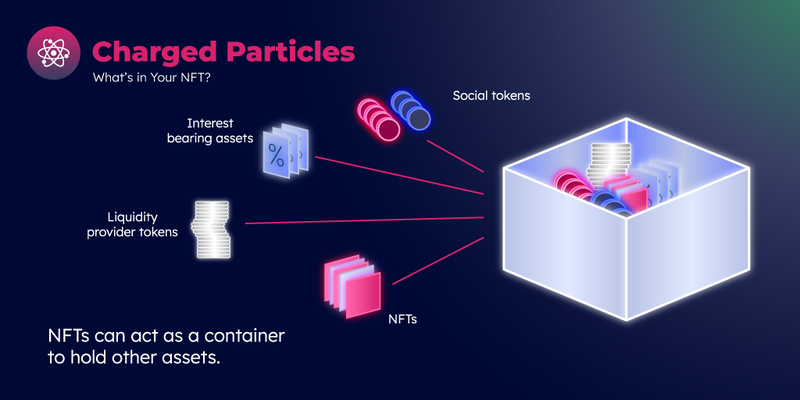

The presentation by Ben Lakoff from Charged Particles helped to reiterate that the capabilities of NFT technology extend far beyond art. Lakoff also shared insight into the “NFT Avatar” market, which includes projects such as Crypto Punks, Bored Ape Yacht Club, Super Yetis, and Wicked Craniums. According to the data presented, secondary sales of NFT Avatars reached almost $350 million (USD) in the second quarter of 2021.

Lakoff highlighted the use of NFTs as access tokens, which allows owners to unlock private content and helps facilitate the creation of community memberships. With global loyalty programs expected to reach $216 billion by the end of 2021, it’s likely more brands and companies will capitalize on this use case of NFTs to drive revenue and strengthen relationships with their customers even further.

What does the future of NFTs hold? According to Lakoff, many platforms are focused on fractional ownership. In theory, it will be easier to split the ownership of digital works when compared to physical assets. Other use cases that are on the horizon include the renting of NFTs, and the ability to use NFTs as collateral for borrowing cryptocurrency.

Charged Particles is an innovative platform, allowing users to deposit ERC-20/721 and 1155 tokens directly into their NFTS. In his talk, Lakoff described NFTs as “gift baskets” that can hold a variety of digital assets. In essence, NFTs can be “charged,” holding tokens that can be completely customized. As the NFT market is extremely young, we will have to wait to see how builders and creators choose to build inside and on top of non-fungible tokens.

Stay tuned for highlights from Day 2 of ETHCC tomorrow, including Vitalik Buterin’s state of Ethereum address. I’m Origin and am live on the ground giving you the latest news at ETHCC 2021.

Make sure to tune in for our Twitter Spaces live from the conference Thursday, July 22nd at 10:00 am EST/ 4:00 pm CEST

#ETHCC[4] is LIVE 🎉 pic.twitter.com/8cvupqZkl3

— EthCC – Ethereum Community Conference (@EthCC) July 20, 2021