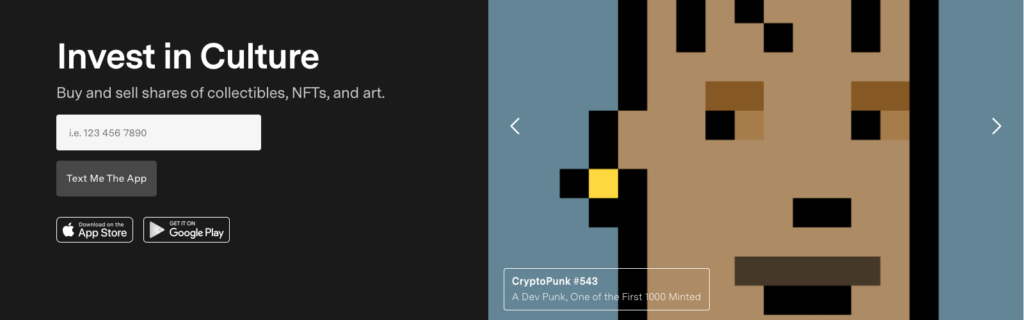

From sports memorabilia to trendy art to Reddit-driven stocks, the worlds of alternative assets, collectibles, and meme stocks are creating a hybrid trading universe that now includes NFTs. Platforms that bring together diverse assets are readily available, and some, such as Otis, Rally, and Masterworks, are securitizing these collectibles with SEC filings. Of these, Otis is now including NFTs and offering a clear alternative to NFT fractionalization using ERC-20 tokens. To date, Otis has fractionalized two CryptoPunks, a Chromie Squiggle, a Meebit, and one of Grimes’ NFT Collections.

Otis: First to Register NFTs as Securities

Otis is an established marketplace for alternative securitized assets such as sneakers and art. Recently they added NFTs to the mix. Otis fractionalizes these items and collections, essentially offering shares in their ownership and a platform for trading them. Though there is currently a significant group of startups in NFT Land exploring fractionalization, Otis appears to be the first and only marketplace securitizing NFTs with U.S. Security Exchange Commission (SEC) filings.

Other NFT startups that are offering platforms to fractionalize NFTs include Fractional, NFTX, and Unicly. All of these use ERC-20 tokens to represent shares in an NFT or basket of NFTs which are then tradable on a growing range of crypto exchanges. These and other DeFi-related experiments connecting NFTs and ERC-20 tokens, such as Charged Particles, are quite creative and have a great deal of potential aside from one problem. Many of these fractionalized NFTs could be considered ‘unregistered securities’ by the SEC.

Registering NFTs as Securities

Under the Howey Test, a guideline used by the SEC to identify securities, a solid argument can be made that NFTs will not be treated as securities while fractionalized NFTs may well be. As SEC Commissioner Hester Pearce recently noted:

“If you take something and you slice it up, and you sell slices of that thing, whether it’s [an] NFT or something else, then that could very much start to look like a security.”

To address such concerns about fractionalization, Otis and a few other startups in the art and collectibles scene, most notably Rally and Masterworks, are registering individual pieces of art and collectibles, as well as collections, as securities.

A representative from Otis informed me that filing NFTs with the SEC was not substantially different than registering any other asset:

“The legal/regulatory framework is the same as with other assets. The only difference with NFTs was that we needed to add additional risk factors and disclosures to our offering circular-tailored to NFTs and blockchain-based assets generally.

The SEC has not made its comments or our response public (their discretion). Generally though, the SEC requested clarifications and additional disclosures, for example, any material terms of the smart contract underlying a given NFT, and did not raise general questions.”

Off To a Solid Start With NFTs

Otis began with three NFTs, CryptoPunk #543, Chromie Squiggle #524, and a Grimes NFT Collection, making them the “first SEC-qualified fractional NFT offering[s].” They then followed with Meebit #12536 and CryptoPunk #2142. Initial auctions establish the owners and then the NFT becomes available for trading on the app. To date, Otis reports a great response with plans to go much deeper with NFTs.

Whether or not the SEC takes action against fractionalized NFTs, Otis finds itself at the intersection of numerous hot trends such as alternative assets and meme stock psychology. Collectibles marketplaces are bringing together communities that were previously distinct, baseball card collectors and sneakerheads, for example. Physical art is being fractionalized for digital trading. And NFTs are emerging as a major blockchain-powered asset class. Otis is able to participate in the convergence of such trends while adding the additional assurance of securities registration.

Link to: Otis Homepage