A few weeks back, I was setting up to pay my taxes here in Canada and was looking for a solution to quantify my crypto investments and gains. Our features editor Joyce told me about an app called CoinTracker, and I started investigating. Through the serendipitous nature of this space, DAO member Jamie Burke introduced me to Shehan from the CoinTracker team mere days later, and I was able to ask him some of the questions that I had myself. Of course, this article is in no way financial advice, and we always recommend that you do your research. However, this seems to be a fantastic new solution solving massive problems for operators in the space. So, without further ado, let me introduce you to CoinTracker:

David: Welcome to NFTS.WTF Shehan, tell me about CoinTracker and what you do there.

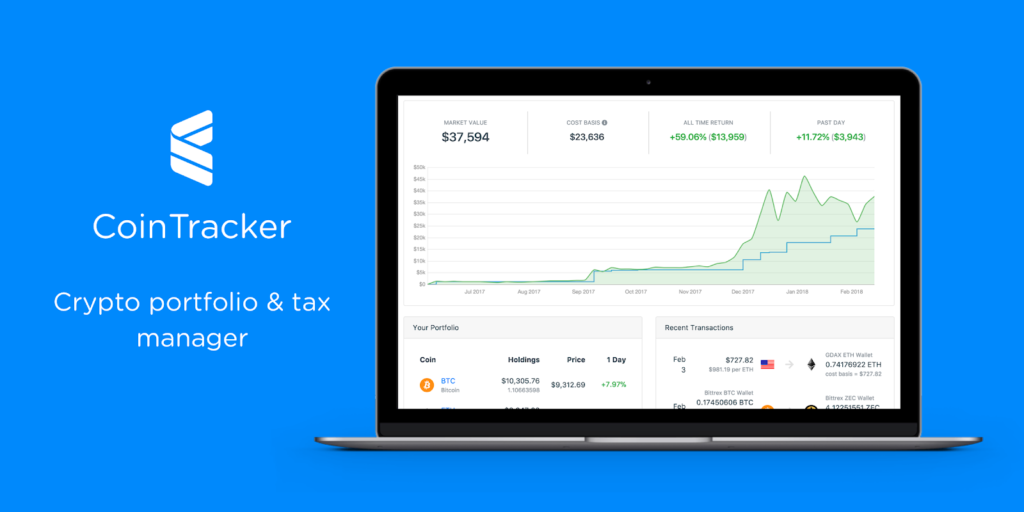

Shehan: Yeah, so I’m the head of tax at CoinTracker. We started building CoinTracker in 2017- and the idea was that everybody was buying into Crypto, but nobody had a useful way of tracking crypto taxes. So, for example, every time you buy a coin, or even an NFT, you have to keep a good record of the cost basis, meaning how much you paid for it because you need that number to calculate a capital gain or loss when you later sell it at [hopefully] a profit. So essentially, CoinTracker is a platform where you can connect your exchanges, wallets, coins, and blockchains- to reconcile all your capital gains and capital losses. And, from this data, produce easy tax forms that you can use to file your taxes.

D: It’s just a simplification of a process that is otherwise super difficult. I’m lucky to say that I make my full-time income in crypto. So when I found out about your platform, it was, I’m not going to say life-changing, but just I think my accountant took like a sigh of relief- because now I can finally consolidate this income somehow.

For people reading, could you give me a couple of use cases of how different people benefit from this?

S: So the process is- first, you have to have crypto, right? I mean, otherwise, you can’t use the platform. And you start by connecting your exchanges and wallets to CoinTracker using a read-only API. You can also upload your CSVs, and then we calculate your capital gains and capital losses- so that’s just one product. The other product that we have is, once you connect all the exchanges and wallets, we track your portfolio. Meaning that you can see your market value cost basis, and you can see how you’re doing overtime, etc. So that’s another useful tool.

We also have more specific tools. For example, we have the taxes harvesting tool. Right now, it’s not super helpful because the market is up but, as you know, crypto goes up and down. So when it goes down, we show you exactly which crypto to sell and the potential tax savings if you were to sell. So a lot of people are using it. So those are the three main products, tax calculator, portfolio tracker, and a tax loss harvesting/ tax saving module.

D: Are you planning on implementing tools to track NFT gains and losses?

S: Yeah, I mean, we do have a separate core functionality for NFTs, meaning when you connect your metamask, we identify what type of assets are inside your metamask. But as of today, we can’t specifically distinguish between crypto coins and NFTs. [Since] in 2021, this space exploded out of nowhere. This is a core strategy that we will implement because we have received so much demand to support NFTs [with the platform].

I think valuation is challenging because, when it comes to crypto, you use multiple data sources, [such as] coin market cap, to evaluate worth. I think it’s easier when you have a USD pair, but in the NFT world, we barely have any USD pairings. So right now, I don’t know the answer. But according to the IRS, I can tell you that if you were to sell something on OpenSea, [for instance], and received a bunch of Etheruem- you would have to look at all the other platforms where Ethereum is being created, and just take a reasonable valuation for that using a block explorer [or a similar solution]. So, from my perspective, for NFTs, we will do the same. And that would satisfy the IRS requirements because there’s no USD pair for NFTs [yet].

D: I think most people’s concerns lie around linking wallets. What makes CoinTracker undisputably safe for users?

S: If you have linked an exchange, all you had to give us is a “read-only access API key.” So the read-only access allows us to see the balances and kind of put that on our dashboard. It doesn’t let us transfer or move any funds, which is very secured. But if you’re still concerned, what you can do is download the CSV reports from your exchange or wallet and upload it to Cointracker [directly] so that it’s completely separate.

D: Do you have any future plans that you’d like to share?

S: We want to have full NFT support before the end of the year. So when you guys file [your] 2021 taxes, it will be fully ready. I think in the coming years, we’re going to make the platform more active. What I mean by that is we’re going to do tips and tricks for you to save on taxes. We started building this by having this tax-loss harvesting module, but there could be some other additions, [such as:] “Hey, this is a good time for you to donate your asset to this charity if you do that, you’ll have these tax benefits.”

If this sounds like a solution that might be useful for you or your company, you can sign up with our official WTF affiliate link for a 10% discount; while supporting our publication.