Damian Hirst, one of the world’s highest-selling artists, is part of the NFT space. Yes, you heard me correctly – I was, at first, confused. Though upon further research into the specifics of his newest drop, my confusion slowly blossomed into intrigue. After his first NFT release with Heni Leviathan allowed him to sell over 7,000 prints grossing him over 22 million USD, he is unsurprisingly back for another go of it. Soon, Hirst will, most likely, sell out his entire new collection of 10,000 physical pieces that people can “apply” to buy at $2,000 each, which he has aptly entitled “Currency.”

All 10,000 pieces come with a red-pill, blue-pill scenario as their principal value add. Do you choose to be shipped a hand-painted physical piece by Hirst himself? Or would you prefer to keep the NFT as a purely digital token? This conundrum leaves many other art collectors and me in the crypto space asking ourselves: why not both? However, this seems to be the point of the collection: to assess the buyer’s relationship with a piece that exists simultaneously in both the digital and physical worlds. Thus, asking the buyer to decide which medium they deem more valuable for themselves. While there are 10,000 physical pieces that have been hand-made to pair up with every NFT, the buyer can only choose to claim one.

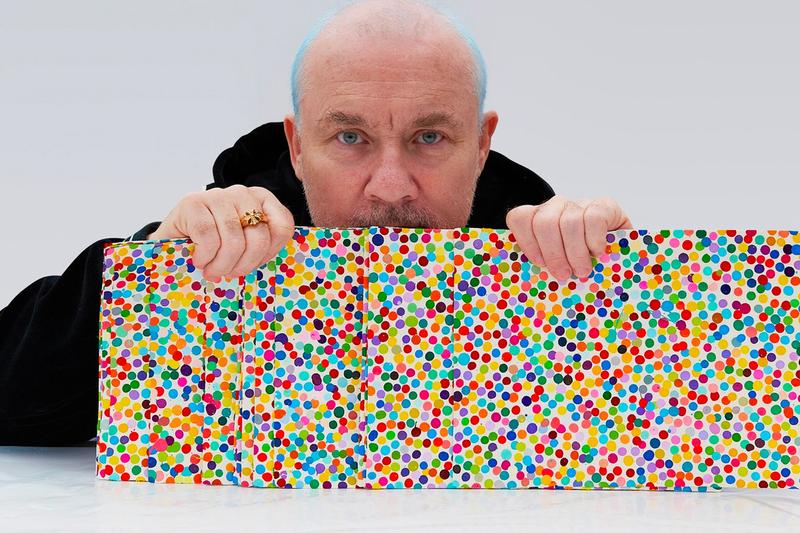

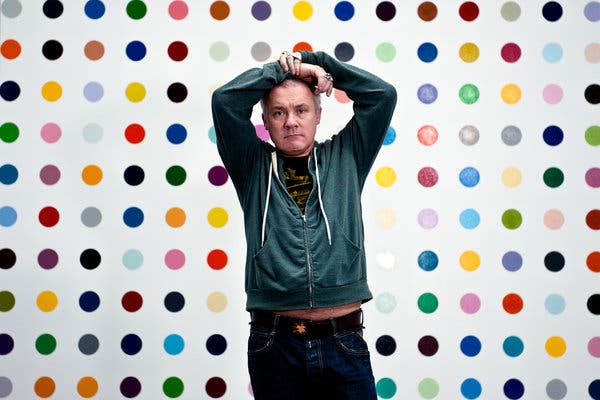

The pieces are derivative of his iconic “spot paintings” which he has been doing since 1988. This could be seen as a positive by some and negative by others. While this is, arguably, his most famous motif, it has become quite a mainstream signature of the Hirst brand. In his book On the Way to Work, Hirst describes his exploration with his spot paintings as “a way of pinning down the joy of colour.” By tediously embellishing art paper with thousands of seemly random colourful dots, Hirst aims to “create […] structure, to do those colours, and do nothing” simultaneously. Blake Gopnik, of the New York Times, explained this sentiment in slightly more detail in a piece for Gagosian:

“The Spots were fundamentally about abstraction as reduced to its most basic components: color, form, and placement. You could say that they represented an attempt to reach Abstraction Degree Zero.”

And now, 10,000 of us have the opportunity to bring an authentic, handpainted derivative of this iconic series into our homes through this NFT launch. Though this drop may be Hirst’s attempt to further break into the increasingly thriving NFT market and thereby the wallets of the crypto-whales this space knows and loves, it seems as if this drop is targeting a far more mainstream audience. Making the pieces available through Heni.com, powered by palm.io, the same chain that fueled the sold-out Space Jam drop, the pieces are meant to be accessible to as wide of an audience as possible. Available for purchase directly with FIAT, interested buyers can “apply” to purchase one of the pieces. And; despite the site mentioning that owners of “Cryptopunks, Hashmasks, Meebits, BAYC, and Art blocks” would be prioritized, it still seems that the drop targets non-crypto-native art lovers. This makes quite a lot of sense for Hirst, considering that still under 1% of the world is fluent within this NFT space and has an active wallet from which to purchase. Especially considering he has an audience of over a million fans across his socials to tap into within the traditional market and a healthy collector-base of some of the most significant living collectors in the entire traditional art world.

But this is NFTS.WTF, and we’re not just talking about the traditional art space here. So we wanted to delve into some of the specifics of this drop from the community’s perspective, especially after mainstream outlets have already begun spreading misinformation as per usual. Such as one article citing that this drop’s blockchain was “99 percent more energy efficient than either Ethereum or Bitcoin” since it is run on a POS chain (lol).

To better gauge the response from the NFTfi community about such a significant artist making his next sizable leap into the NFT space, I asked a few leading members of the WTF DAO what their thoughts were in regards to this historic drop:

Silversurfer

According to NFT collector and DAO member Silversurfer, he’s planning on “buying one [piece] to keep as an NFT and one to keep as a physical” if he can get in. Furthermore, he “personally think collectibles from actual artists are more valuable than apes/punks/cats and much cooler.”

When chatting with other DAO members about the drop in more detail, he also touched on another valuable point. That in his eyes, “the point of the experiment is to show everyone what is valued more, the physical or the digital?” And I agree.

Brinkman

According to artist and NFT aficionado Bryan Brinkman, he thinks that “it’s certainly going to be interesting to see if the 10K model works at that price point.” Brinkman points out that “Meebits did 5K at 2.5eth, so it’s possible, but most 10K projects are sub .1eth,” in contrast with this collection which sits around 1eth. Despite this, Brinkman said that he “signed up” and that “its certainly tempting to own an affordable Hirst that isn’t a ‘print.’” He believes that “it’s a cool bridge from the old work to the new,” but he also thinks that “it’s not fully diving into the space,” since “the NFTs feel like a checkout mechanism to buy his physical work.”

I quite agree, and though I appreciate Hirst’s work, this does seem like a lot of exposition to still just get a physical piece. Granted, at a much lower price point. Though, according to Brinkman, he thinks “he could have done this project, but as a generative art NFT on artblocks and made just as much.” Brinkman believes that “the fact he’s doing [a] physical shows his reluctance towards the NFT space, and his need to appeal to his traditional collectors which honestly, is a safe move.”

And he’s right! While Hirst is “a big name,” most “people in this space care about Apes and Punks, not Koons and Hirst.” Brinkman aptly mentioned that “there have been MoMA artists on SR flying under the radar for 1-2eth” for quite some time.”

J1mmy Eth

The collector and founder, formally known as @j1mmy.eth, has quite a legendary digital art collection. From being one of the largest holders of Bored Apes to founding Avastars and Nameless, amongst other institutions in the space, he has a great perspective on the climate of digital art. According to Jimmy, he purchased “some of his prints from the HENI thing a few months back.” However, despite Hirst’s reputation, Jimmy doesn’t necessarily “agree with the method/experiment/use of NFTs that have to be ‘traded in’ for ownership of a physical.”

Furthermore, according to Jimmy, “it shows a lack of understanding of the tech” since NFTs in-and-of-themselves “are proof of ownership, and [his] belief is Palm or anyone working with a person new to NFTs, like this artist, should try to explain how this all works and how it makes no sense to burn proof of ownership to receive an item.”

Instead, Jimmy suggests that Hirst and the team at palm simply mark pieces “as redeemed in metadata and include additional information about said redemption.” Without doing this, questions such as “is it burned?” or “is it traded in?” quickly arise.

Jimmy stressed the fact that when a piece is “burned [it] isn’t really burned, it still exists, just [as] a dead address.” So when this happens, an “owner is just relinquishing ownership of something, not ACTUALLY burning it.” Because of this, they can’t simply say that “the supply is actually reduced” since “the ownable supply is, but not the total NFTs in the collection.”

Giovanni / Fragcolor

Giovanni Petrantoni, founder and CEO of Fragcolor chimed in to agree with J1mmy. Staring that this burning situation “opens up a scenario where people can fork a network if [they] really wanted to revive an NFT trade.” Following up that they are “sure that given enough value, someone might play this card one day.”

Giovanni also wanted to clarify that “the chain needs all of the transactions to regenerate itself, always” and that “it’s immutable.” So the burning simply “sends something to an unusable address,” stopping the trade and allowing “the network [to] become the owner, you might argue.”

In this case, Giovanni would recommend simply marking the tokens as “redeemed… [as a] more elegant [option] than burn.”

Conclusion

These are excellent points to consider for anyone thinking about purchasing one of the limited edition pieces in this collection. While Hirst is more than a reputable artist in the traditional art space, what we’ve learned is that the crypto space moves quite differently. I am sure that this drop will be a success, but I also believe that Hirst and his team still have quite a lot to learn about this space, and I look forward to seeing how his next drops will even further integrate the power that NFTs can unlock for the creator and consumer. While this drop is an exciting and psychological journey into the thought process of the collector, I believe that Hirst can go further, especially within the realms of unlockable content and additional value adds through granted access.

However, this is only his second time attempting a drop within this space, and he’s been functioning at the highest levels in the traditional art world for over three decades. So, I’ll cut him some slack. And actually — I’m considering buying one — are you?